What’s included in bookkeeping services? A complete breakdown

Before you launch a startup, you must know how to run it. But once your business is up and running, many things can distract from your day-to-day company operations—like tax season (dreadful but necessary). Bookkeeping solutions can help alleviate some of the stress of managing finances and allow you to focus on what matters most — growing your business.

While we’re happy to provide info and make recommendations, we know you are the ultimate expert on what’s best for your business. This info is intended to help you make an informed decision, not make it for you.

Core bookkeeping tasks and what to expect from a service

Bookkeeping services typically include a range of core financial management tasks that help ensure your business stays organized, compliant, and ready to scale. An individual bookkeeper, a firm, or a hybrid software-backed provider like Pilot may offer these services.

Here’s what’s commonly included in bookkeeping services:

- Transaction categorization: Sorting and labeling your business income and expenses

- Bank and credit card reconciliation: Matching your books with your financial institutions

- Accounts payable and receivable tracking: Monitoring outstanding bills and incoming payments

- Financial statement preparation: Generating key reports like the profit and loss statement and balance sheet

- Monthly close: Reviewing and finalizing books at the end of each period

- Invoicing and bill pay (optional): Sending invoices and paying vendors

- Payroll support (optional): Managing employee compensation and tax compliance

Some providers offer all of the above as part of a full-service bookkeeping package, while others may only deliver the basics like transaction categorization and monthly reconciliations. Understanding what’s included in bookkeeping services from the outset ensures you’re choosing a provider that fits your business needs.

What does a bookkeeper do vs an accountant?

While there may be some parallels, accounting and bookkeeping are distinct in function. Let’s start with accounting. An accountant is a professional who provides financial advice to business owners and individuals. Accountants offer a wide range of services, including tax planning, tax preparation, online bookkeeping, and payroll management. They may also provide more specialized assistance in areas such as forensic accounting or auditing reports on financial statements.

Accountants tend to focus on the long-term strategy for your business rather than its day-to-day operations. For example, an accountant might suggest strategies for reducing your tax bill through deductions or finding ways to increase revenues with additional capital expenditures that result in higher net income (and, therefore, lower taxes).

As a result of this focus on the big picture, however, accountants can’t always be counted on for day-to-day tasks like balancing ledgers or entering data into computer systems. Instead, they’ll need assistance from other professionals, such as bookkeepers, who can help them accomplish these tasks while still giving them time to focus on more important matters.

That brings us to bookkeeping. A bookkeeper sees your day-to-day transactions and ensures that what you’ve recorded as having happened did happen. The most important measure of successful bookkeeping is accuracy, and inaccurate books can cause a company many tax and legal problems.

Aside: One of the founding principles behind Pilot was the belief that great bookkeepers, when equipped with powerful software, could deliver faster and more accurate books at scale. That’s exactly what we offer—especially for startups that need dependable, investor-ready financials without building an in-house finance team. See how Pilot works

A bookkeeper provides decision-makers with digestible, timely, and accurate financial information. Consider accounts receivables, for example. A bookkeeper would be concerned with the accuracy and completeness of the data, while an accountant might look at the data to determine how long, on average, it takes for customers to pay in full. In turn, that insight could inform company policy.

Also, at smaller firms, an accountant may do bookkeeping in addition to their core functions, but rarely does a bookkeeper handle accounting tasks. The main reason is that accounting is a regulated, strategic activity, whereas bookkeeping is not; you must get certified to become an accountant, while anyone can become a bookkeeper.

Who should you hire first: a bookkeeper or an accountant?

Some businesses hire an accountant to handle their finances and a bookkeeper to manage day-to-day operations; others choose one person to fulfill both roles. Whatever you decide, the two sides of your business must be in sync. Considering hiring an accountant or bookkeeper first? Weigh these questions:

- Are you more comfortable with numbers and contracts? If so, then hiring an accountant will make sense for you.

- Do you prefer dealing with paperwork and people? Hiring a bookkeeper may work better for your business.

Getting a bookkeeper and making accounting decisions yourself might be more valuable if you’re a small business or startup with limited resources. Knowing that you can trust the data you’re seeing—and it will hold up at tax time—is fundamental. Without accurate data to review, an accountant can only do so much.

Conversely, retaining both bookkeeping agencies and an accountant would be preferred for larger organizations because they have the financial resources to afford both, and their books are likely more sophisticated than smaller companies.

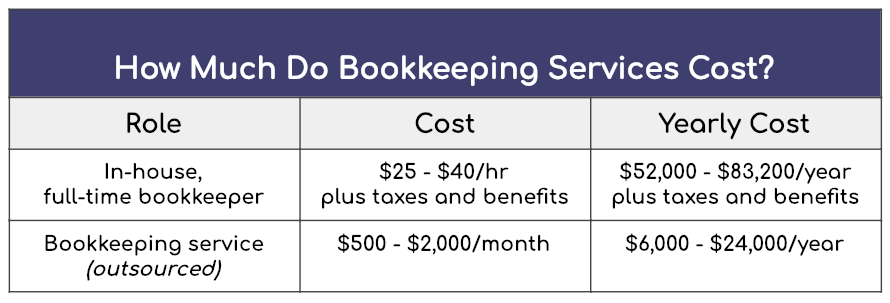

How much do bookkeeping services cost?

Whether you’re a small business or a large corporation, bookkeeping services can range in cost. The more complicated your business’s finances are (e.g., the more invoices and receipts you have), the more time-consuming it will be for your bookkeeper to keep track of them. This means that costs will increase as well.

Here are some typical cost ranges broken down by type:

Many businesses find the prices of these bookkeeping services worth it since they save so much time using their bookkeeper’s services instead of doing their bookkeeping themselves. As the saying goes, “Time is money.”

If hiring a bookkeeper sounds like something that might suit your business needs, but you’re unsure whether or not having a professional handle your finances would be worth it, there are many other options available besides hiring an entire bookkeeping team.

Types of bookkeeping services offered

Below are the main types of online bookkeeping services:

- Full-service bookkeeping. This is the most comprehensive online bookkeeping service, including client communication, tax preparation, and more.

- In-house bookkeeping. Typically more expensive than online bookkeeping services but includes more functions like invoicing and payments. Generally speaking, the more human hours needed to handle your bookkeeping, the more expensive it will be.

- Tax preparation. If your business needs help with its taxes, an online bookkeeping service can provide this for you and other accounting-related services.

- Payroll services. This includes payroll processing, employee management, and benefits administration tasks, so you can concentrate on running your business instead of worrying about payroll paperwork.

Sometimes you’ll pay more or less than the ranges mentioned above; you may pay more if you run a large business with complex financial interactions or a difficult toolset and less if you’re a small business with little complexity. However, if you’re paying considerably more than the average price range with only simple bookkeeping needs, it’s time to start asking questions — and probably shop for a new bookkeeping service.

It’s worth noting that Pilot’s bookkeeping service,, is on the lower end of the range in the table above. That’s because while most bookkeeping services are human-only, Pilot leverages powerful software tools to handle the most error-prone calculations to ensure better accuracy and fair prices (learn more about how we do that here).

How to choose the right bookkeeping service for your business

Bookkeeping is a vital service that can help grow your business, but choosing the right one can take it to even greater heights. Here’s how to find the right one for you. If you have a small business, keeping track of your financial data on your own may seem overwhelming at first. However, bookkeeping is essential to running any company or organization and should be done correctly from day one.

As you grow, bookkeeping will continue to be an important aspect of your business. That’s why starting with reliable services is best so that you don’t run into problems later down the road due to poor record-keeping practices or an unreliable service provider who leaves you with inaccurate figures in their reports.

In terms of finding the right provider, examine your company’s financial responsibilities, e.g., the volume of daily transactions, account payables and receivables, payroll, etc., to determine how sophisticated your bookkeeping service needs should be. In our opinion, a hybrid bookkeeping service that combines powerful software tools with human expertise to provide highly accurate bookkeeping is your best option, especially if you’re a startup.

A note on QuickBooks

QuickBooks is the most popular bookkeeping and accounting software today (and the one we use and recommend to clients). But many other software solutions—such as Wave and Freshbooks—are popular options for small businesses and startups.

Before you contract with a bookkeeping service, ask them what software they accept and whether they can facilitate your transition to another software if needed. Several clients came to us specifically because we do all their bookkeeping in QuickBooks Online, but it’s important to note that not all bookkeepers use software that’s easy to transfer.

Bottom line: Choose a bookkeeper who will work with you and the tools you’ve chosen for your company.

Why Pilot bookkeeping services stand out

Like most startup founders, you probably care that your books are accurate, timely, and easy to understand. That’s why at Pilot, our team of experts is supercharged with technology to consistently deliver complete, triple-checked financials so that you can confidently make decisions and run your business. The result is a more effective bookkeeping service.

Ready to stop stressing about your books? Pilot delivers complete, accurate financials powered by experts and automation. Try Pilot bookkeeping.

Key takeaways about bookkeeping services

- Bookkeeping services can vary widely knowing what’s included helps avoid gaps and ensures the service matches your business needs.

- Most providers handle core tasks like categorization, reconciliations, and reporting, while some also offer bill pay, payroll, and monthly close.

- Aligning with your provider on expectations is essential, especially as your business grows and financial needs evolve.

- Pilot stands out by combining software automation with expert oversight, reducing errors while delivering consistent, accurate financials.

- For startups and growing companies, this hybrid approach means better clarity, less manual work, and books that scale with your business.