Top 5 risk assessment software

Creating a listicle on the best risk assessment bookkeeping software for 2025 involves identifying platforms that not only provide comprehensive bookkeeping capabilities but also excel in identifying, assessing, and managing financial risks.

Such software plays a critical role in enhancing financial security, compliance, and decision-making by analyzing patterns, predicting potential financial pitfalls, and offering insights for risk mitigation.

Below is a carefully curated selection of top risk assessment bookkeeping software, each chosen for its unique strengths in addressing the multifaceted needs of businesses focused on minimizing financial risks.

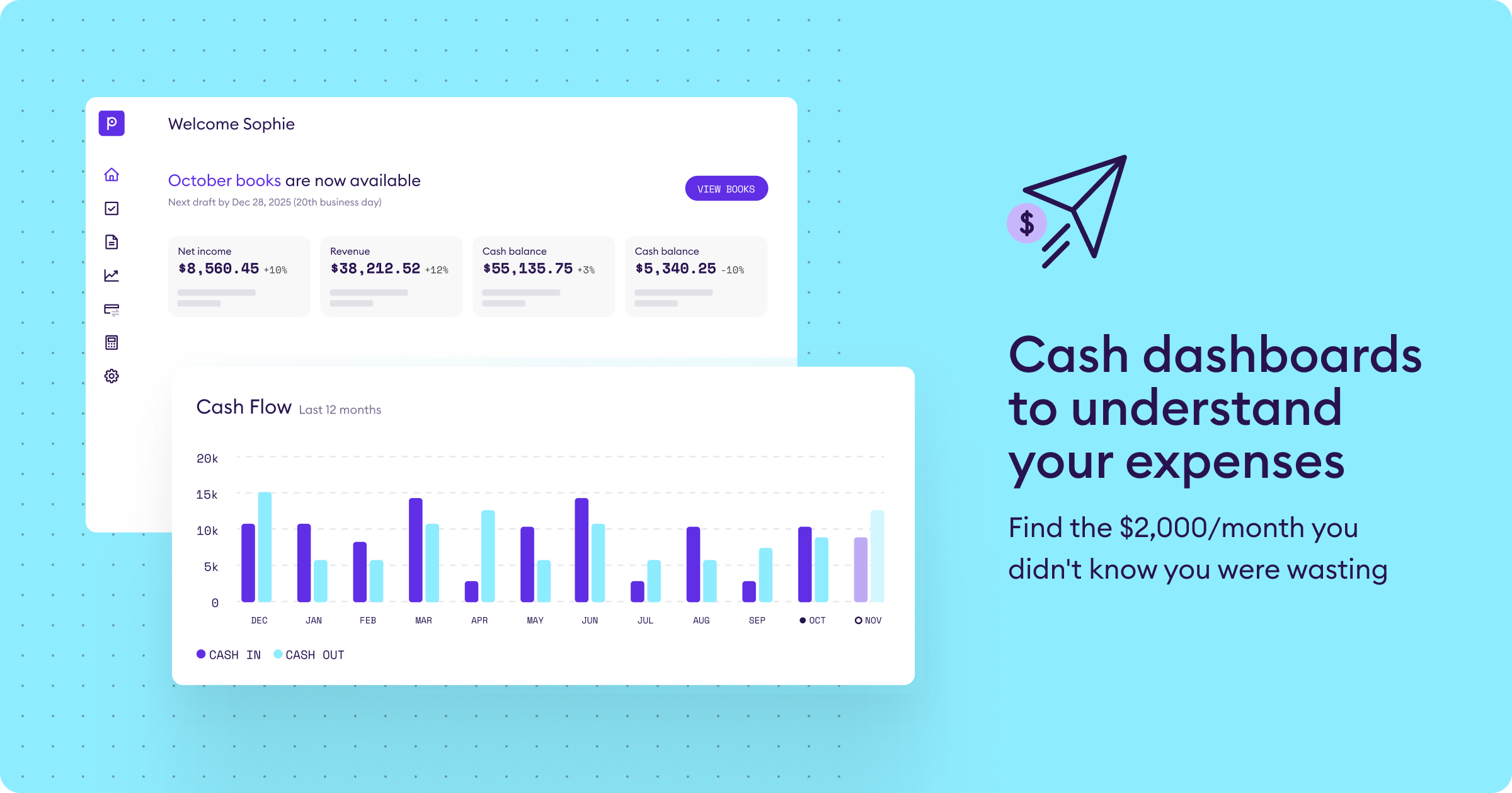

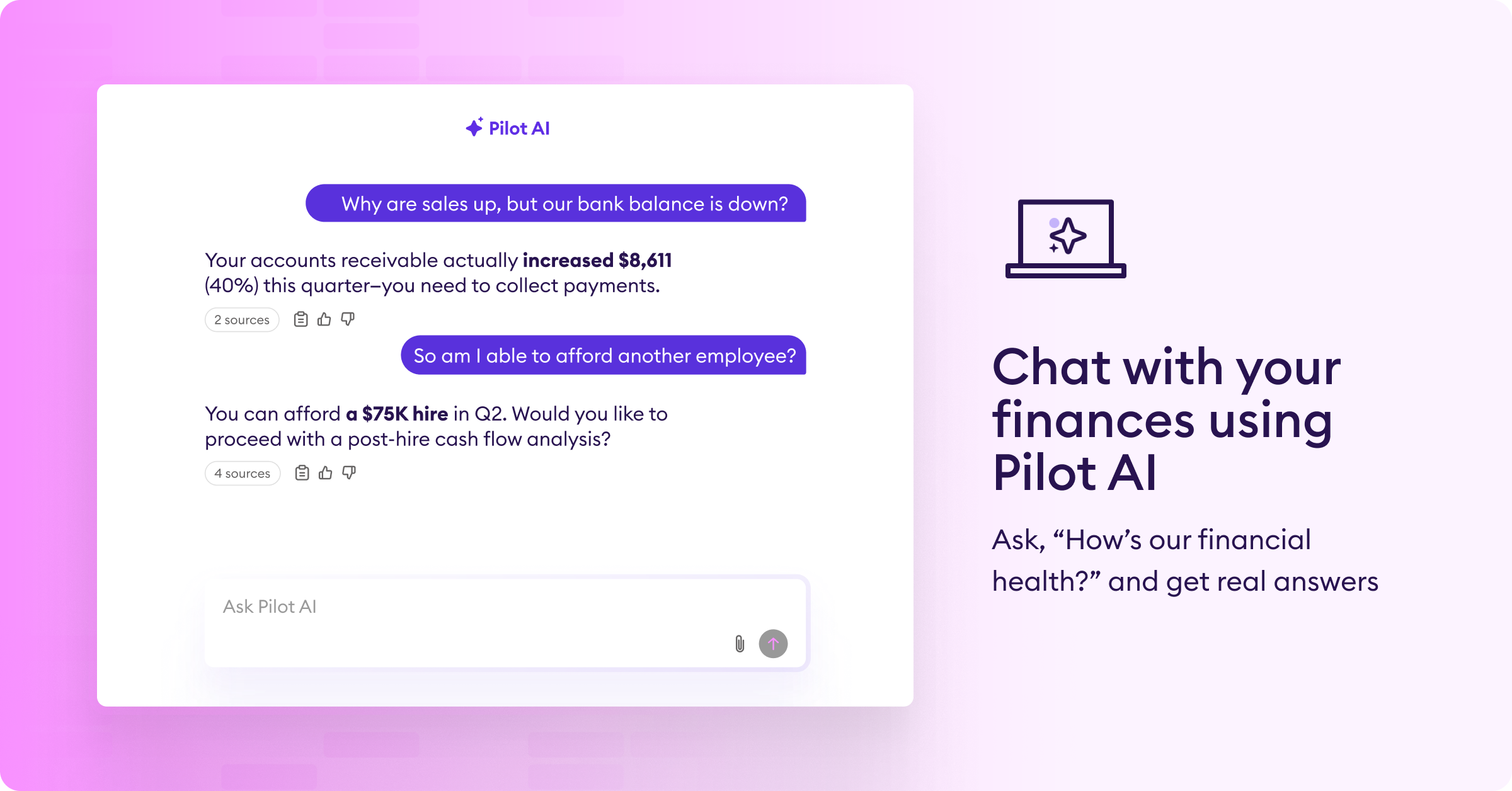

Done-For-You Alternative: Pilot

Pilot's advanced bookkeeping services remain at the forefront, not just for its financial analysis tools, but also for its robust risk assessment features. We stand out for our predictive analytics and customized reporting, which are vital for risk management and financial planning.

- Use cases: Ideal for startups and expanding businesses that require sophisticated financial insights, risk assessment, and mitigation strategies.

- Features: Advanced financial reporting, risk analysis, compliance tracking, and access to finance experts for personalized risk management advice.

- Price: Starting at $499/mo. You can find more information here.

1) Riskalyze

Riskalyze is specifically designed to assess financial risk, making it a powerful tool for businesses focused on risk management within their bookkeeping practices. It leverages cutting-edge technology to quantify and manage financial risk, providing tailored recommendations to safeguard against potential financial uncertainties.

- Use cases: Suitable for financial advisors and businesses of all sizes looking for detailed risk assessment capabilities integrated with their bookkeeping software.

- Features: Risk score analysis, portfolio risk assessment, automated risk detection, and mitigation recommendations.

- Price: Custom pricing based on business needs and the scale of risk management features required.

2) BlackLine

BlackLine offers a comprehensive suite of finance and risk management tools that include advanced bookkeeping functions. Its real-time risk assessment and control monitoring capabilities make it an excellent choice for businesses seeking to maintain rigorous financial controls and compliance.

- Use cases: Best for medium to large businesses and enterprises needing scalable solutions for financial risk management and compliance.

- Features: Continuous monitoring for risk and controls, automated reconciliations, variance analysis, and compliance tracking.

- Price: Pricing is tailored to the size of the organization and the scope of features required.

3) NetSuite

While primarily known for its ERP solutions, NetSuite also offers strong risk assessment capabilities through its financial management platform. Its risk management features are integrated with bookkeeping and financial planning tools, allowing for seamless risk analysis and mitigation.

- Use cases: Ideal for small to large businesses looking for a comprehensive ERP system with built-in risk assessment and financial management capabilities.

- Features: Real-time risk analysis, compliance management, financial planning, and analytics.

- Price: Custom pricing based on the module and feature requirements.

4) Sage 50cloud

Sage 50cloud combines traditional accounting software features with cloud-based risk assessment tools, providing a solid foundation for small to medium-sized businesses to manage their financial health and minimize risks.

- Use cases: Small to medium-sized businesses in need of reliable bookkeeping software with added capabilities for financial risk assessment.

- Features: Cash flow forecasting, fraud detection, compliance management, and financial reporting.

- Price: Starting at $50.58/month for the Pro Accounting plan, with more advanced features available at higher tiers. You can find more information here.

5) Intuit QuickBooks Enterprise

QuickBooks Enterprise goes beyond the basics of accounting and bookkeeping to offer specialized risk management tools. It provides comprehensive insights into financial data, helping businesses predict and prepare for potential financial risks.

- Use cases: Suitable for small to large businesses needing robust bookkeeping software with enhanced risk assessment and management features.

- Features: Advanced reporting and forecasting, customizable financial analysis, risk and compliance alerts.

- Price: Starting at $1,922/year for the Gold plan, with more extensive features in Platinum and Diamond tiers. You can find more information here.